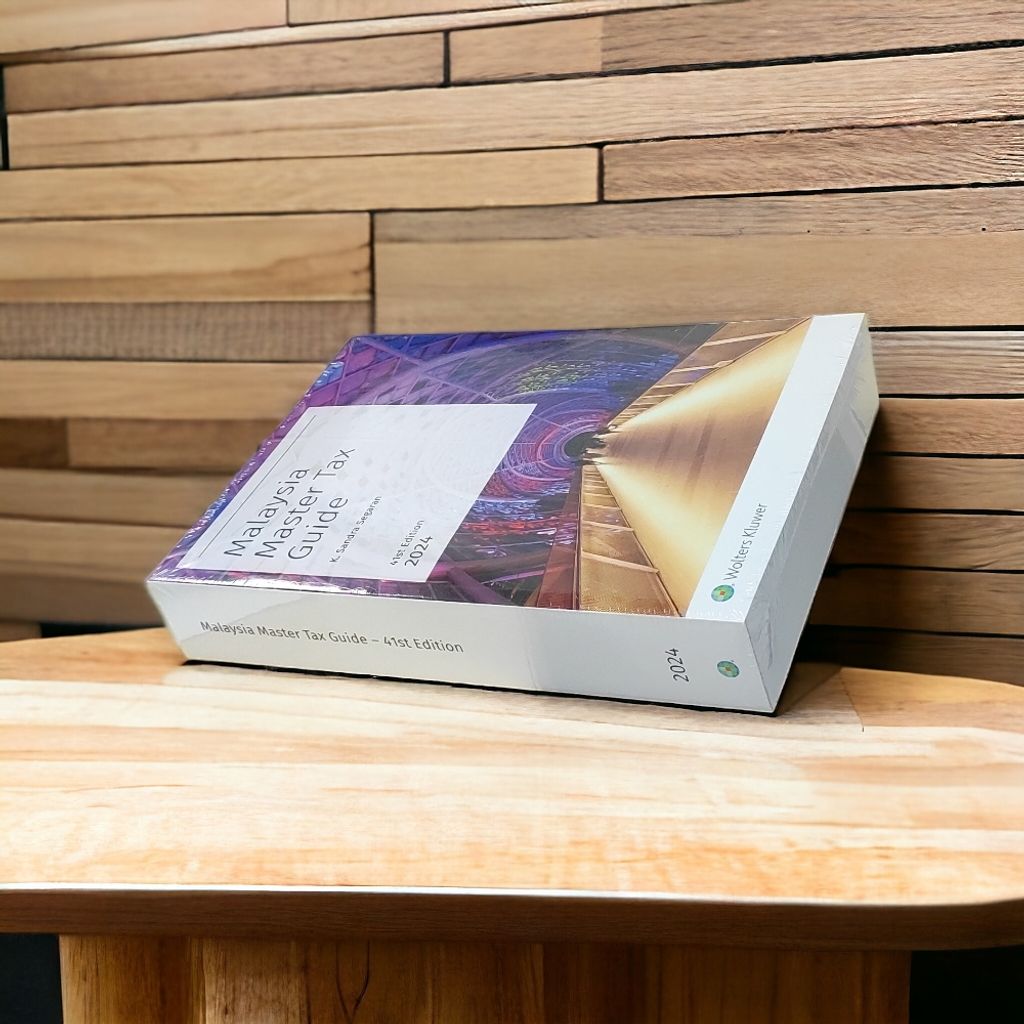

Malaysia Master Tax Guide 41st Edition 2024

- Regular price

- RM 68.75

- Sale price

- RM 68.75

- Regular price

-

RM 68.75

Share

The Malaysia Master Tax Guide is a practical, accurate, and dependable overview of the structure, characteristics, and scope of Malaysia Income tax law and practice. It describes how the legislation relates to individuals, partnerships, limited liability partnerships, companies, and other taxable entities, as well as essential information on stamp duty, real property gains tax, double tax treaties, and investment incentives. Readers will obtain a better understanding of tax statutory requirements as well as their obligations in preparing and submitting tax returns and resolving tax disputes. This Guide has earned its reputation over the last four decades as Malaysia's leading annual tax guide because it covers each year's tax developments clearly and concisely.

The law as it stands for this iteration is valid until and including 31 December 2023.

KEY FEATURES:

- The 41st edition includes all tax changes made since the previous edition (2023), including modifications imposed by the 2024 Budget, as well as the most recent exemption orders, rules, and case judgements reported

- Up to date content, rates, and tables

- Comprehensive coverage with worked examples of tax applications includes new, updated, and reworked examples

- Extensive cross-referencing, indexing, and finding aids

- The user-friendly approach assists users in finding answers to their tax issues.